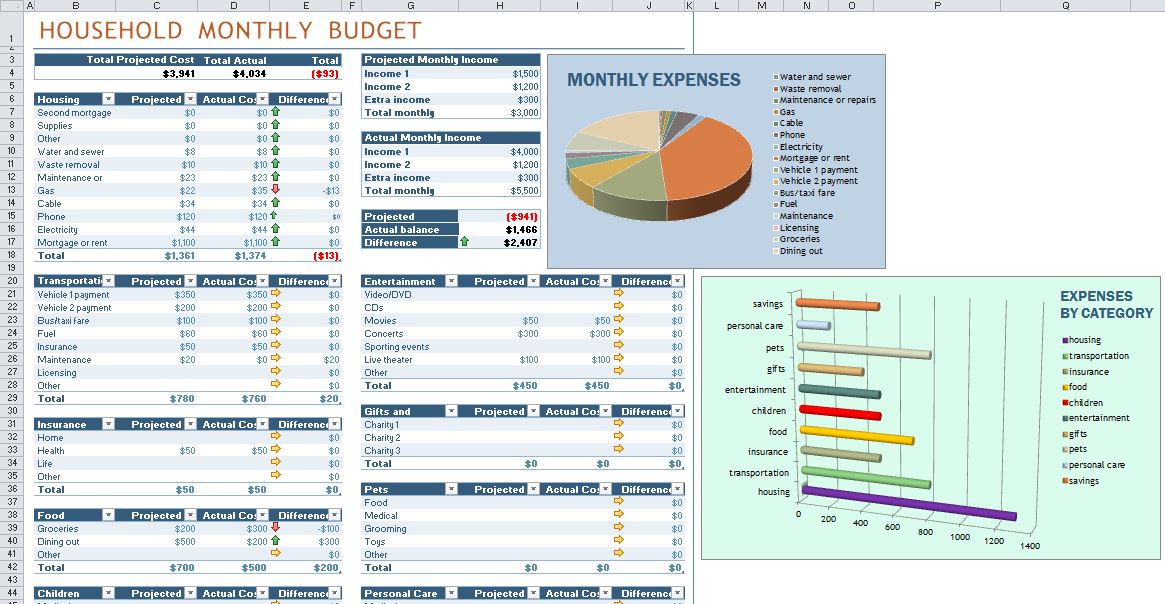

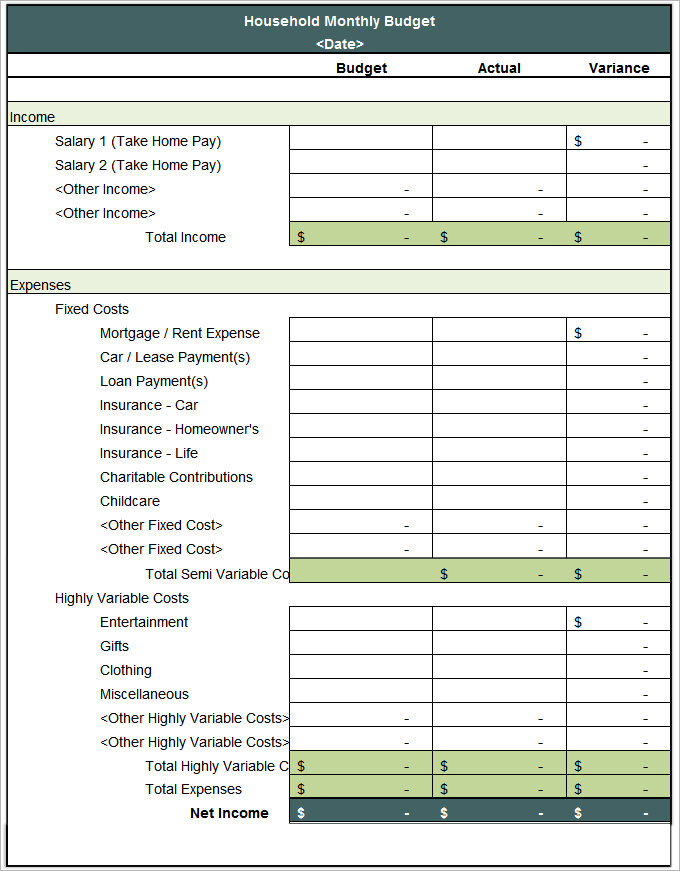

These are more or like stable and can be comfortably decided based on the consumption rate. A set amount is allocated for the grocery and other needs like clothing, education, salon, etc. It is the most common expenses for every monthly budget. Any student loan or payment towards alimony Alimony Alimony is court-ordered financial support given to a spouse in case of divorce or separation and is given to the spouse with a lower level of income or no income at all. The credit card today pays a significant role in everyone’s life and all the payments made towards credit taken and captured here. The borrower can access any amount within the credit limit and pays interest this provides flexibility to run a business. This part is majorly related to the loans or line of credit Line Of Credit A line of credit is an agreement between a customer and a bank, allowing the customer a ceiling limit of borrowing.

The complete investment needs are taken care of here, which includes retirement planning premiums to the contingency fund. The emergencies can be a sudden job loss, emergency medical issues, or big losses in the financial market. Since it is readily available for withdrawal, savings invested in the emergency fund act as a savior during unforeseen circumstances. It also means the creation of emergency funds Emergency Funds An emergency fund is a source of money that you refrain from spending and store away safely to use in the time of need. It includes allocating funds towards investments from our savings and paying of retirement premiums and other required savings plans. This section captures all the premiums and investment-related fees that we must pay towards our investment needs. Any miscellaneous amount spent against property is also captured in this section. The repairs spent on home or maintenance amount spent over the property and the property tax paid are also shown here. Internet, which is an essential requirement for every home now, is also captured in this section. Also, expenses like electricity, gas, water, telephone, and cable are captured here. It takes care of the home loan, which is the EMI paid to the bank. Here in this part, all the expenses related to home/house gets captured. read more from investment and additional recurring/non-recurring incomes flow. The other section can be interested in deposits earned or dividends earned Dividends Earned Dividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the company’s equity. We capture all the possible sources of income and add it up as the total income. A person can have multiple sources of income.

Here we take into account all the income-related numbers. Finally, the net arrives, which is either positive or negative. Here we calculate the difference between projected and actual income and expense. A positive net means income is more than expenses, and a negative net means expenses are more than income earned. Finally, the net gives us the difference between expenses and income. The total expenses take the addition of all the expenses which are possible in one’s lifestyle. The total income is the addition of the incomes one gets from various sources. Here we need to enter the set budget/projected balance we plan to allocate from our regular source of income. It sets up an initial budget balance and also gives a projection of the end balance, which is expected to be there after deductions of all the expenses from the incomes. The household budget template captures all the sources of income one has and also the spending.

0 kommentar(er)

0 kommentar(er)